- Joined

- Jul 21, 2014

- Messages

- 9,770

- Location

- Broken Arrow, OK

- Display Name

Display name:

SoonerAviator

Let's see if we can keep this non-political . . . what consequences do you see as a result of the Middle Class wealth shrinking (as a proportion) and being absorbed into estates of the wealthiest of Americans?

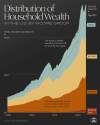

Wealth distribution in America has become increasingly concentrated since 1990.

Today, the share of wealth held by the richest 0.1% is currently at its peak, with households in the highest rung having a minimum of $38 million in wealth. Overall, roughly 131,000 households fall into this elite wealth bracket.

With $20 trillion in wealth, the top 0.1% earn on average $3.3 million in income each year.

The greatest share of their wealth is held in corporate equities and mutual funds, which make up over one-third of their assets. Since 1990, their total share of wealth has grown from from 9% to 14% in 2023—the biggest jump across all wealth brackets.

In fact, the richest 0.1% and 1% were the only two rungs to see their share increase since 1990.

Meanwhile, the greatest decline was seen across the 50-90% bracket—households in the lower-middle and middle classes. Those in this rung have a minimum $165,000 in wealth with the majority of assets in real estate, followed by pension and retirement benefits.

Averaging $51,000 in wealth, the bottom 50% make up the lowest share, accounting for 3% of the wealth distribution in America. Income growth across this bracket has increased by over 10% between 2020 and 2022, higher than all other brackets aside from the top 1%.

Overall, the top 10% richest own more than the bottom 90% combined, with $95 trillion in wealth.