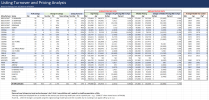

Data Notes:

- Note: the time period for this report is not the typical ~1 month interval, it's nearly 3 months! (I've been busy

)

- Turnover figures have been removed from this report because of the irregular data report interval (much longer) makes them not comparable (compared to previous monthly frequency)

Observations:

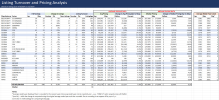

- +9% increase in total listings. There's more people looking to sell now compared to May.

- Median pricing down -5.7% over the period, avg pricing down -3.1% with only a few series bucked that trend.

- As shown before lower priced models sell faster. Not a shocker. That trend continues.

- 172s got roughed up a little. There's 12% more for sale, they're selling for less (-8% median px chg) and they're taking almost a month longer to sell than in spring.

- There's 40 percent more Cherokee PA28s for sale now than in spring (

this category does not include Warriors btw) and they're taking about a month longer to sell. Price hasn't moved much.

- I love Arrows as much as anyone (evidence: see username) but some of the owners just aren't serious. A simple search of this category's asking prices reveals many owners are residents of Clown Town.

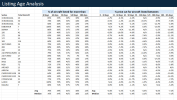

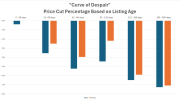

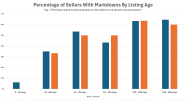

Listing Age observations - a more interesting item right now, prescient for Kaiser to ask about it...

- The average listing age extended from ~90 days in May to ~112 days now. The median increased from 69 to 77. That's a big increase. It indicates things aren't selling as quickly across the universe.

- High end of the market still has lower turnover than expected and its also reflected in the lengthening listing age: SR22s, 36Bo's and PA46s. (SR22 87-> 111 days, 36 Bo's 84 days ->125 days, Malibu 121 days -> 201 days).

Data: