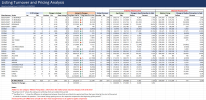

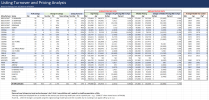

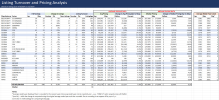

Totally. After looking at the data nearly every week for 6 months I have yet to see any real outliers in SR22s!

Partly due there not being much variability across the fleet, other than time in service and pre-repack or post-repack.

Totally. After looking at the data nearly every week for 6 months I have yet to see any real outliers in SR22s!

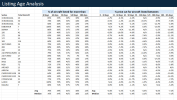

There is lots of variability in the models and there isn't enough of them in the market (low N) in order to create some stability. Archer, Acclaim, Sierra, Debonairs, Musketeers (which I dropped)... They've all had low N and been bumpy.For models with low numbers (Archers, 150s) you are getting huge swings (40% increases), is that because of the long production runs and variability of prices? I would ignore new planes and focus on used prices.

Somewhere recently I ran across a couple for sale in Alaska that were freight dogs. Original radios, trashed paint & interior, and 15k hours. I'm sure that's them. Considering what it would cost to bring them up to something a private owner would want, they're probably overpriced.At those prices, 3 of those Lances on the motivated list must be trashed.

There is lots of variability in the models and there isn't enough of them in the market (low N) in order to create some stability. Archer, Acclaim, Sierra, Debonairs, Musketeers (which I dropped)... They've all had low N and been bumpy.

Unfortunately there's not many ways around it unless I manually curate the listings that are included with each series, which I don't think I should do.

For instance... All it takes to swing the Archer market above is like 3 guys to list a late 70s Archer with a good glass panel and newer SMOH times and you're going to see a huge spike in prices. I'm not really in a position to say that shouldn't be counted. Same for Malibus. I've seen "avg" swings of 100k because 5 people have 80s models for sale and 2 people list a >=2012 model year PA46. That market is so small that 1-2 listings does legitimately swing the aggregate asking prices.

The solution (to me) is that I frankly don't really give hardly any attention to low N series. If I see N less than 15-20 I figure it's going to be an erratic series. Thankfully because of their low prominence in the data they make very little impact on the aggregate market stats at the bottom.

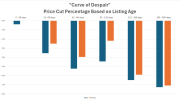

The guy in #1 has dropped over 40% since September.

For a handful of the big N series aircraft (172/182/arrow/PA28/M20/SR22...) I could setup an index benchmark, standardized to only include 1 or 2 model years, if that would be helpful? That would give some standardization for the aircraft series.Any chance of normalizing the list prices? For example factoring in the year, a crude way would be price/year.

Coming into this post 2 years later and seeing how prices just kept on climbing is really depressing.

Fair point, but even you guys can't be pleased with how costs for parts (esp engine components and avionics) have exceeded the climb rate of a Saturn VNot for us who have been owners

Don't worry, as soon as you buy something prices will come back to earth.Coming into this post 2 years later and seeing how prices just kept on climbing is really depressing.

Coming into this post 2 years later and seeing how prices just kept on climbing is really depressing.

EDIT: I'M A CLOWN! I posted data without checking the data. Whoops!Parts and labor? Sure. Airframe resale prices? No, that hasn't been my observational experience since fall of 2023. Certainly not inflation adjusted. But I'm not following all aircraft types, just a small sliver of it (trike FG acro 2-seater EAB).

We have no reliable mechanism for disclosing completed sales (mine wasn't, other than self-disclosing on social media). So the notion that prices "have gone up" in what the statement seeks to imply (completed sales), is facts not in evidence.

Listing prices are just like anything, a wish. Even then, listing prices have flattened to slightly decreased in the types I've been looking at. Inventory is starting to pick up. Some people still living in 2020 list for the moon, don't get bites (or pearl-clutch when one comes in with an under asking offer) and pull the listing. Based on my recent experience as a passive buyer, lots unserious sellers chaffing up the listings, merely trolling the market. I'm not chucking from the cheap seats, I was a seller in 2023 and completed in 14 days, and my available market was way more limited mind you (AOG sale). It's not just airplanes, even housing suffers from that dynamic in present circumstances; my clown neighbor for instance, still there sitting unsold.

My process will not collect data for aircraft listings filed as fractional/partial ownership. But if it's listed as a normal sale and the posting itself has text buried in it saying that it's a fractional/partnership share, then that would make it into the data. The only way I'd catch it is downstream when I manually investigate outliers and then eject them from the data.I track just the Mooney M20J, since April 9 the average price has gone up slightly. I don’t know how sophisticated your data mining is, but 1 example is one of the M20J listings is for a fractional ownership, so the price is 1/2 of the value of the plane. So if counting it without adjusting makes for a 3% difference in the average price.

..or almost a $1mil Comanche.

..or almost a $1mil Comanche.

Any other time I would be 100% certain that it's a typo. Now, not so sure.

Ha ha, it got fixedThink your brain might have accidentally added a zero. Or the ad got fixed.

I just manually checked each of my M20J listings of out of curiosity and I did not see any cases where the listings were fractional.

I did however find this gem that, if anything, will cause M20J *average* prices to show a huge increase: Anyone want to buy a $348k M20J?

I can confirm a listing like that would not make it into the data.Here is one:

1996 MOONEY M20J MSE For Sale in Mobile, Alabama

1996 MOONEY M20J MSE For Sale in Mobile, Alabama at Controller.com. Clean, well-cared for, fast and efficient machine. Upgrades include Precise electric speedbrakes, co-pilot brakes and SureFly electronic ignition (replaced left mag on 12/2022). 1,075 SMOH 4,600 AFTT Garmin GNS 530 (plans to...www.controller.com

Yup. Knew it would be the case in 3-5 years for all of them. New toy feeling wears off by year 3, they realize they aren't using it much anymore and are having to foot the bill for storage $200+ each month. By year 4 they want out of it and by year 5 the market it saturated with toys of similar kinds so demand/supply results in prices falling pretty quickly. Good way to grab end-of-season deals on boats and rvs that previously sold for $65K and are now $40K.Thought this was a relevant article (WSJ) despite covering other recreational markets...

View attachment 129708

Yup. Knew it would be the case in 3-5 years for all of them. New toy feeling wears off by year 3, they realize they aren't using it much anymore and are having to foot the bill for storage $200+ each month. By year 4 they want out of it and by year 5 the market it saturated with toys of similar kinds so demand/supply results in prices falling pretty quickly. Good way to grab end-of-season deals on boats and rvs that previously sold for $65K and are now $40K.

Yeah, we've got an old 20' bowrider that runs just fine. We only take it out a few times per year due to busy weekends with sports as well as a FIL who already has a boat and docks on the water. I'd love to upgrade, but it doesn't make a ton of sense to do so. I also get free storage for my toys in my father's shop, so I don't fret too much about storage fees like most do.My FIL is right there right now with a bass boat he bought 2 yrs ago. He offered it to me if I just took over the payments.

It’s a decent enough new bass boat with less than 50hrs on it, but I’m not into it, especially for $33K left on the note.