bflynn

Final Approach

The US and Europe are not getting rid of pollution, we just offshore it to places in the Middle East, Africa, Russia and China.

I'm stealing that.

The US and Europe are not getting rid of pollution, we just offshore it to places in the Middle East, Africa, Russia and China.

The US and Europe are not getting rid of pollution, we just offshore it to places in the Middle East, Africa, Russia and China.

Sure, and it has worked that way. More refineries are being built, just not in the USA because of Government intervention. It is nearly impossible to get the permits here to build a refinery, so the market works and companies (and countries) build refineries in places the regulations aren't nearly as strict.

Same happened in Europe.

The US and Europe are not getting rid of pollution, we just offshore it to places in the Middle East, Africa, Russia and China.

I'll buy that to a point. It doesn't explain shutting five refineries down here in the US in the past two years, with another on deck. The plants are still intact, just mothballed. Shut down due to lack of demand is the word. Well, demand is back as evidenced by price.

I

Do you know why Japan attacked us at Pearl Harbor? It wasn't because there weren't hourly flights from Dallas to Houston

The big FBO (also the only FBO) at our airport has an "avgas club" for tenants - pay $20/month up front, get a substantial discount off the listed fuel price. They adjust the club price on the first of each month. As of July 1, the club price went down forty cents a gallon from the previous month.

At that, I'm buying 100LL for not much more than premium unleaded for my Audi at the local discount gas station.

I mean, seriously, they have never done a mid-month adjustment before. And it’s a DECREASE. I definitely don’t hold them guilty of price gouging.

I don't expect refiners will be lining up to invest in new production capacity as electric cars continue to increase in numbers.Prices are decreasing because I tankered up pre-Oshkosh at one of the less expensive airports. You're welcome!

From 0.001 % to 0.002%.I don't expect refiners will be lining up to invest in new production capacity as electric cars continue to increase in numbers.

I don't expect refiners will be lining up to invest in new production capacity as electric cars continue to increase in numbers.

From 0.001 % to 0.002%.

I don't know............what factors might have contributed to the closing of refineries?

March 2020?

November 2020?

If you were told "Hey, we plan to put you out of business" by the government, at the same time you are losing billions per year because the world is shut down, do you think you would invest in updating infrastructure? Especially when there was a glut of refined products on the world market?

Or would you say.......mothball them (not really the case, the largest was damaged in a Hurricane, the other larger one was up for sale for two years and nobody wanted it even at a discount) and maybe wait until the political tides turned a little?

The people running downstream energy aren't a bunch of morons. They would LOVE to have more capacity right now, it would be like owning a printing press for money. But even bringing a shut down refinery online doesn't make financial sense to them......yet.

Think about this, right now the government is sending BILLIONS to Ukraine to fight it's war. Why didn't congress allocate money to downstream energy to get these refineries up and running? Why is our president going to Saudi Arabia to beg them to increase production (and refinery production as well), but not going to Houston or Midland? He called the Saudi's a pariah during the campaign. I guess he thinks us Texans are worse than Pariah's.

Domestic Oil and Gas employ a huge number of Americans in well paying jobs. They also support smaller companies like my own that put millions into the economy. And domestic production and refining is a national security matter. But we are put under more and more regulation, some of which is shutting down production.

But back to offshoring our pollution and jobs to make the greens happy.

That's my Ted Talk for today. Back to filling orders to these dirty O&G production companies.

Edited to add this to remain on an Aviation topic:

The US Government flooded the airlines with billions of dollars to keep them operational and used "National Security" for the cover to do so.

But not one dollar went to O&G. Why is that? Why are airliners more important to national security than O&G.....

Do you know why Japan attacked us at Pearl Harbor? It wasn't because there weren't hourly flights from Dallas to Houston

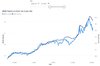

is the RBOB always front month? or just the historical pricing of the current front month?I'm a data driven guy (I run a data analytics team, afterall) so here's your graph of the day, made by yours truly off of NYSE RBOB data and EIA national pump averages. Sure, this isn't avgas, but it is interesting anyway. It's interesting that the back half of 2021 didn't fully follow the curve like it did in 2020. Then the ramp up in price stayed in line for March and April 2022 and then June again. Right now another gap has formed on the downside. This supports the argument that things don't fall as fast since you don't see the same kind of gap on the way up. Either way, as long as futures start to stay steady or continue to fall, the graph would indicate we are on track for a 75 cent per gallon drop at the pump. Oil is down to $92 and falling at the moment.

View attachment 108622

I'm not a futures trader so I don't know the lingo. The price I used for yesterday's close is the August contract. However, as you can see above, I forced the axes to match at the front so I could see how they move together. The correlation for 2020 and most of 2021 was pretty close so I felt it worked. Open to suggestions on other ways to view it.is the RBOB always front month? or just the historical pricing of the current front month?

If the graph is RBOB Aug22 only, then you'll see lower volatility (& pricing changes/response) the further you are from the contract date.I'm not a futures trader so I don't know the lingo. The price I used for yesterday's close is the August contract. However, as you can see above, I forced the axes to match at the front so I could see how they move together. The correlation for 2020 and most of 2021 was pretty close so I felt it worked. Open to suggestions on other ways to view it.

I don't think that is what the data is doing. I think it's a rolling one-month ahead view (meaning the June data in the graph is the July contract, etc.). I'll have to check the source.If the graph is RBOB Aug22 only, then you'll see lower volatility (& pricing changes/response) the further you are from the contract date.

Since I know you're a data guy, another interesting way to view this relationship would be to take each front month and meld the data - say on a rolling 6 weeks or so. On that note, volatility spikes inside 2 weeks to the expiration. Back when I did stuff like this, I'd always focus on the time between expiration -6/8 weeks and -2 weeks.

This is all assuming futures pricing actually matches reality - which sometimes it doesn't.. like when front contract oil went to zero (Apr 2020?)

Oil is down to $92 and falling at the moment.

Corn fell out of bed this week too if it makes you feel any better.Of course.

Anyone wanna learn how to invest should follow me and do the opposite of what I do...

Of course.

Anyone wanna learn how to invest should follow me and do the opposite of what I do...

When I went to school, the way the market was supposed to work was high prices was supposed to lead to more competitors entering the market. Instead, we have refiners closing, and aging plants going without required maintenance to keep operating...and massive share buybacks.

Demand has started dropping.Why are oil prices dropping did we find an alternative to Russia

Until I can afford itHow low do you want a twin to go? In the market?

Have twin prices fallen? If not, I’d be ok with higher fuel prices a little bit longer.

Why are oil prices dropping did we find an alternative to Russia